3 Things You Need to Know About the U.S/Canada Trade War

25% tariffs are here. Here are the short, medium, and long-term outcomes we can expect to see.

It’s been a chaotic 24 hours.

Yesterday, the White House confirmed that major tariffs were on their way — targeting America’s three largest trading partners: China, Mexico, and Canada.

In response, Prime Minister Trudeau announced retaliatory tariffs targeting $155 billion worth of American goods over the next 3 weeks (a move mirrored by Mexican President Claudia Sheinbaum).

Canada and America have one of the largest bilateral trade relationships globally, but it would seem that the days of collaborative Free Trade are gone.

As we enter into this uncertain period, what can we expect for the future? Well, it’s important to first dive into what tariffs look like, and how they work.

What are Tariffs?

A tariff is essentially a tax paid on imported goods.

Why Use Tariffs?

There are many different reasons for using a tariff, which may include:

Increasing national revenue through import taxes (see “Who Pays for Them” section)

Reducing reliance on foreign exports

Protecting domestic companies and jobs from cheaper foreign goods

Applying economic pressure to a trading partner

"Sometimes it's to reduce the trade deficit. Sometimes it's to bring back jobs. Sometimes it's to punish other countries for their unfair trade practices. Sometimes it's to raise revenue so that we can cut income taxes."

— Douglas A. Irwin, Dartmouth College Professor of Economics

Who Pays For Them?

Contrary to what Trump has falsely claimed, tariffs are actually paid for by domestic importers (eg Maple Leaf Foods, General Motors, etc). The border services agency (in Canada, this is the CBSA) then collects the tariff payment from domestic importers — and these dollars are then deposited into federal coffers.

Who Ultimately Pays for Tariffs?

Because domestic importers are paying more for imported goods, they will then mark up the price they sell to domestic consumers (i.e. the general public). Americans imported $724.75 billion (CAD) worth of goods from Canada — so tariffs on all these Canadian goods will really hurt the average American consumer.

Okay, with that cleared, let’s look at the potential impacts of this Trade War on Canada.

Short Term Impacts (Jan-Apr 2025)

Immediate Price Increases — You expect to see prices jump on many American-made goods, especially convenience products (eg fruits, vegetables, drinks), shopping products (eg mobile phones), and specialty products (eg jewelry, refrigerators, etc).

Supply Chain Disruptions — Given that our supply chains are so highly integrated, expect significant disruptions — which may lead to rise in production costs and potential shortages. (Remember the Suez Canal tanker blockage?)

Job Losses — Many of our industries depend heavily on trade with America, especially manufacturing (eg auto industry). Some estimates pin this at 344,000 full-time equivalent jobs lost.

Market Instability — Already we’ve seen the Canadian dollar take a plunge, in large part due to investor fears over further disruptions to business and trade.

“So Trump built a wall, but it’s a wall targeting us. Trump’s tariff tax is an attack on Canada and who we are.”

— Manitoba Premier Wab Kinew

Medium Term Impacts (May-Dec 2025)

Economic Slowdown — It’s projected that both Canada and America will experience a decline in economic growth, some projecting a big drop in Canadian GDP in 2025. Other economists suggest both countries may experience a recession in the medium term.

Inflation Rising — Tariffs blocking trade will contribute to inflation, there’s no doubt about that. This may lead to the Bank of Canada hiking interest rates in response.

Industry Restructuring — Some industries (eg auto manufacturing, oil & gas) may need to restructure or relocate production, which may also displace jobs.

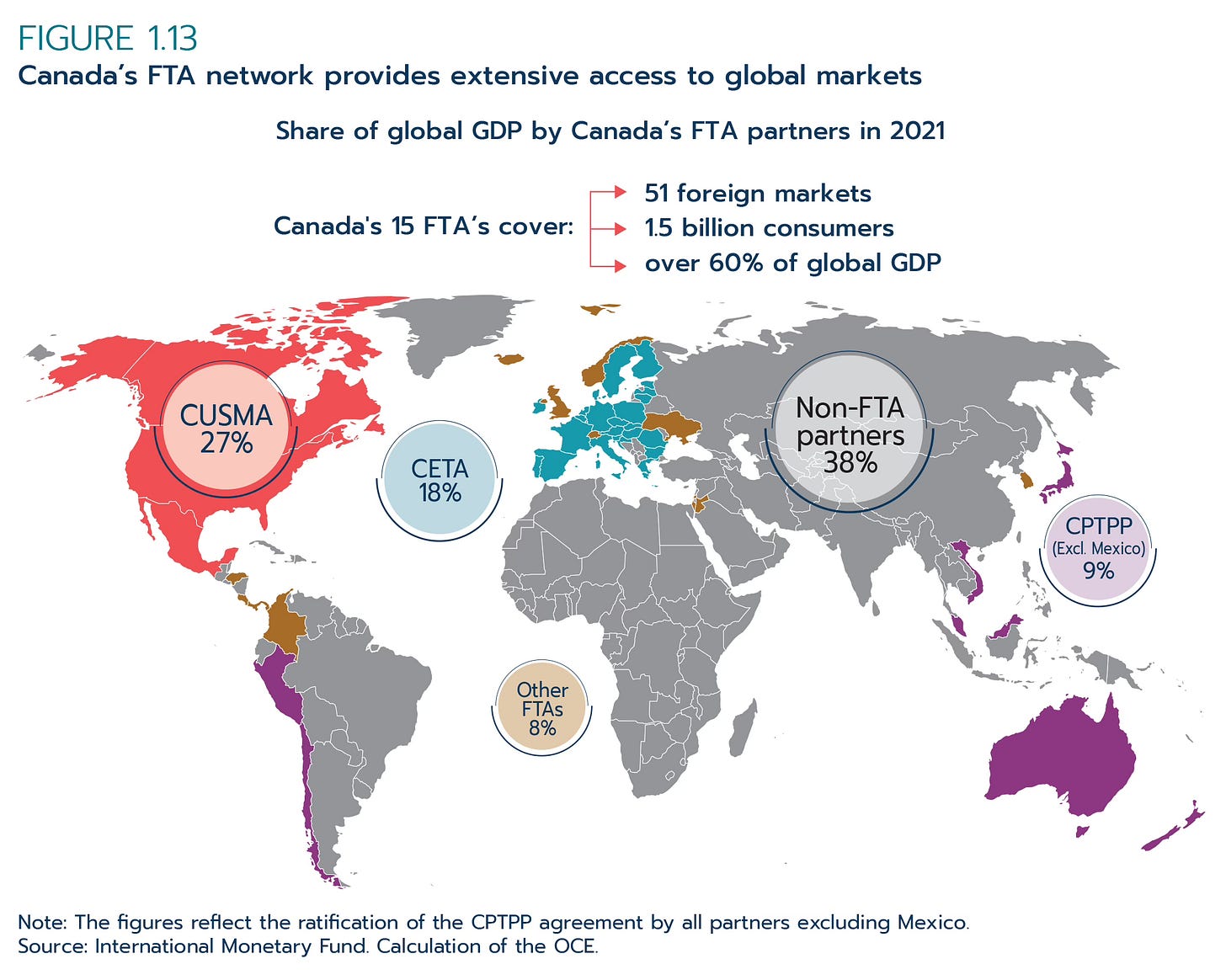

Trade Diversion — Canada will certainly look to accelerate its diversification of its network of trading partners, and start weaning itself off of dependence on American trade.

“High tariffs inevitably lead to retaliation by foreign countries and the triggering of fierce trade wars. The result is more and more tariffs, higher and higher trade barriers, and less and less competition.”

— U.S. President Ronald Reagan

Long Term Impacts (2026 and beyond)

Reduced Global Competitiveness — These tariffs will certainly reduce global competitiveness of both countries’ industries, particularly those with highly integrated supply chains (eg auto manufacturing).

Investment Uncertainty — Again, if these tariffs continue into 2026, we can expect to see investors scared off from long-term investments in affected industries (eg auto manufacturing), which may then ripple into slowed innovation and productivity in Canada.

Major Structural Changes in the Economy — It’s likely we will see permanent shifts in our economy, with some industries declining (eg possibly electric vehicle manufacturing) and others emerging.

Diplomatic Tensions — Already you can see how tense the relationship is between Canada and its largest trading partner in the government’s official press release on retaliatory tariffs, citing Trump’s use of “unjustified and unreasonable tariffs”.

Policy Shifts — Besides shifting the policy priorities for parties in our upcoming federal election, we can expect to see further economic policies towards trade diversification, and (potentially) more protectionist measures.

“Canada has a broad and growing global trade network. With our Export Diversification Strategy, we intend to broaden our reach by achieving 50% more overseas exports by 2025.”

— Global Affairs Canada

Next Steps

This trade war will hit us hard, but it also provides some much needed opportunity to wake up Canada. Sometimes it takes a crisis for us to get anything done.

We have been too dependent on the U.S. for too long, but this realization can hopefully push us to address some of the issues we’ve been ignoring for decades. — diversifying our trade networks and removing interprovincial barriers should both be at the top of that list.

But right now, there’s no doubt that this has radically changed our relationship with the U.S. — perhaps irreversibly so. As Sarnia Mayor Mike Bradley put it:

“It’s like a marriage that’s come to an end.”

Figure 1.13 taken from Global Affairs Canada’s State of Trade 2022 report.